Very professional and effective, I will definitely be recommending you

It's a brilliant product.

As a Solicitor you are responsible for the accurate completion of your clients’ CPSE s32. Many Solicitors are facing litigation for the consequential loss of tax savings due to inaccurate or poorly advised entries. But we can help.

We'll let you know within 24 hours if your client has a claim for Capital Allowances.

You'll only need to enter minimal details about your client and their property, we'll deal with the rest.

See the status of all of your searches in one simple dashboard.

Once we have completed our checks, we'll provide you with the completed entries.

You’ll receive a response to your search within 24 hours. If there is a potential claim, we will arrange surveys, collect information and provide a report with the completed s198 or s199 forms.

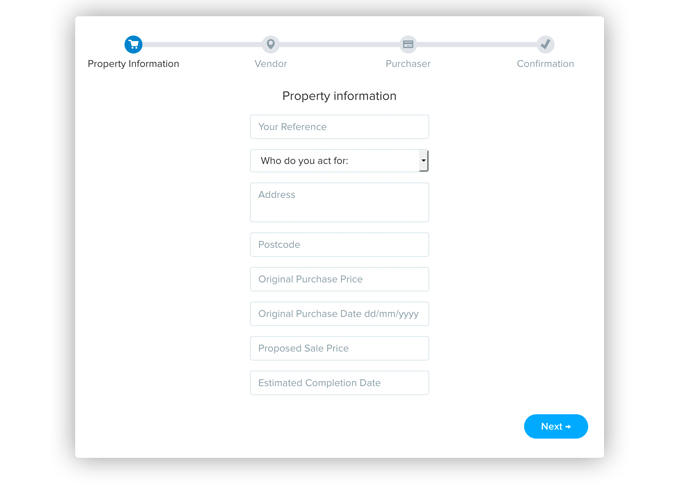

Along with the address, we will need to know when the property was purchased and what was paid for it.

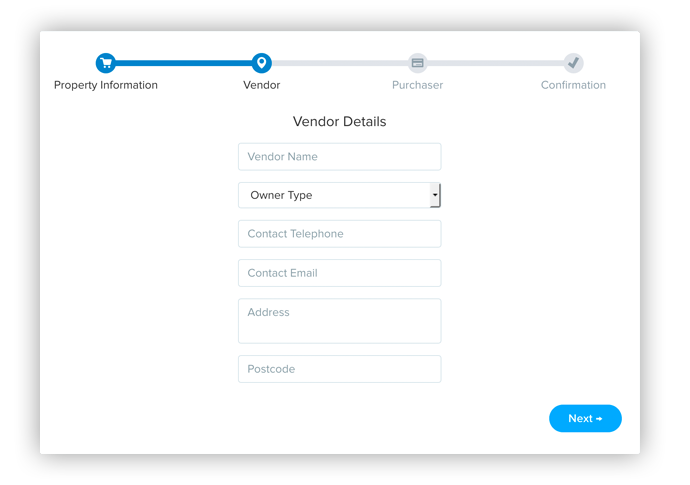

We only need basic contact details and if they are buying or selling a property.

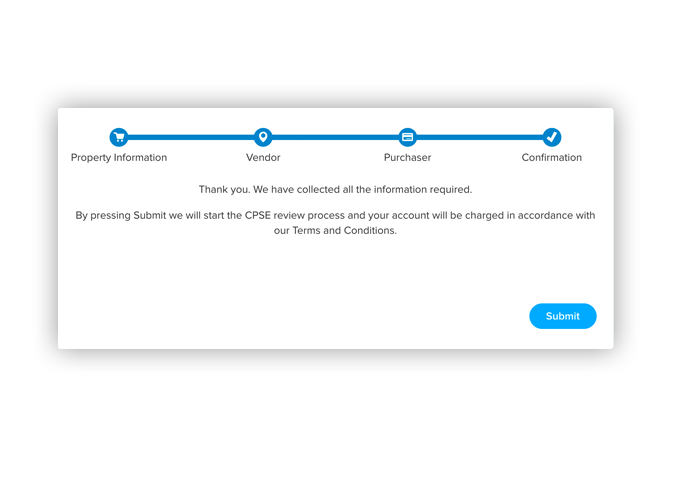

That’s it! We’ll run our checks and collate the information we need to accurately advise on your client’s tax position. If there is a potential claim, we’ll let you know.

Our fully integrated online solution takes only minutes to complete and provides total indemnification for your company.

We provide a completed s198 or s199 form after assessing the capital allowances position of your client’s property. Our system is fully traceable with real-time information available via your custom online dashboard.

We regularly identify up to 35% of the property purchase price in allowances.

Every claim we have ever submitted

to HMRC has been approved.

In a recent Law Society survey

over 2 thirds of Solicitors said they

would refer clients for s32.

Our team have identified over £60m

in allowances for our clients.

We recently won New Business

of the year at the Chamber Awards.

A search takes less than

5 minutes to complete.

Very professional and effective, I will definitely be recommending you

It's a brilliant product.

I couldn't believe my Solicitor didn't do this, and when I found out I was able to claim back a substantial amount of tax just in time for the sale.

A professional service from start finish - it generated a nice tax rebate and I'll also gain in the coming years.

If you need any help, we have a great support team – just click here.

Copyright © Headley Meredith Associates. 2018. All Rights Reserved.